Reduce compliance cost , improve profitability, and drive strategic growth

Proud Partners with

Our genesis came about by tax, insurance and finance leaders wanting to finally bring to the insurance sector substantive value using current technology employed in other sectors.

This “brain trust” of cross functional and industry averaging 20+ years financial services expertise partnered with leading technologist to compose a tax, and core business platform to leap ahead of what has become a stagnant technology space …

A secure cloud based solution "up and running" in less than 90 days. Subscribe, deploy, and start gaining value today!

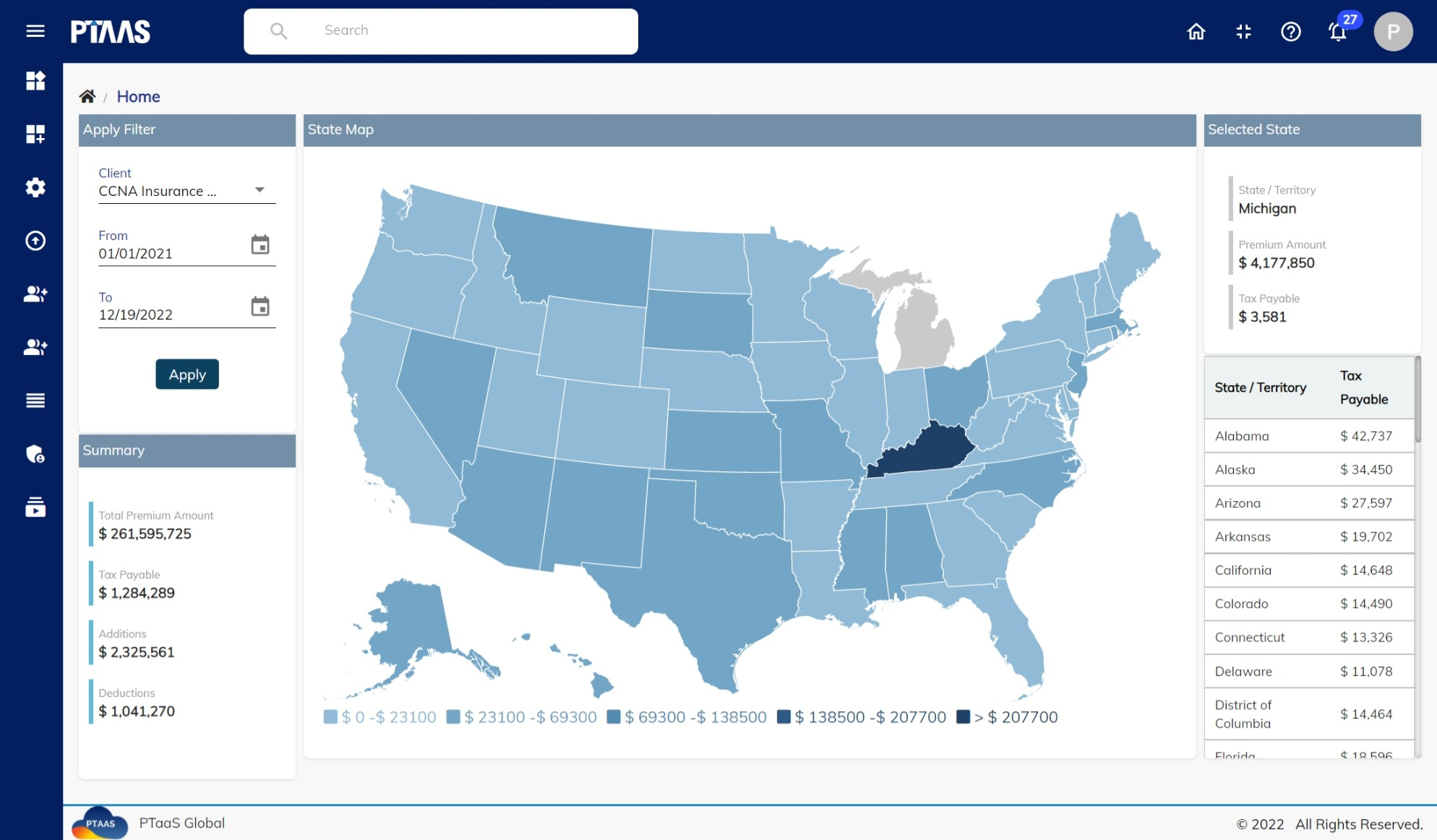

Deliver a reusable geo-based data source for finance, tax and core business analytics. Enhancing underwriting, sales and finance decisions

Identify more accurate tax liabilities, reduce compliance costs, avoid tax penalties and gain insights into premium profitability at the policy level

Out of the box analytics, and functionality designed to provide value to multiple user groups including finance, tax, compliance, underwriting, sales and marketing professionals, All from a single source of truth and simple integration with core systems

Eliminate manual effort. eliminate offline spreadsheets, calculate precise tax to a policy level, all while reducing tax penalties, with fully automated workflow, embedded machine learning, and tax tables continuously updated for thousands of tax jurisdictions

Coded tax calculation rules grounded in current tax law and utilizing a database of tax credits allowed across the 50 states and 3 US territories. Together through transparent cloud based technology our tax engine "churns" your policy level data through efficient and detailed calculations. If that was not enough, your tax, finance, and underwriting teams can use this data for enhanced market forecasting and analysis

Avoid underpayments resulting in penalties or unrecoverable overpayments. Either which are caused by manual calculations or archaic technology. Using the data that was always available but could never be fully standardized, consolidated or presented timely. Can now be used at a level of detail to support future audit defense. and shorten any audit cycle

In the United States alone, we have the capabilities to support over 2,700 insurers and 3,700 self-insured entities. a number that is growing every year. Internationally, we can support companies operating in countries, where tax rates can reach up to 21%

In this PDF and videos, we explore key features and benefits of PTAAS and our SAP Analytics platform capabilities. We’ll highlight how together they can help tax and business professionals reimagine their tax processes and find opportunities for tax savings.